Market Summary

Major market indices increased in the quarter, led by strong returns in the Technology sector, specifically centered around Artificial Intelligence (AI). Across the market cap spectrum and for the second quarter in a row, Growth indices outpaced Value while Large Cap indices outpaced Small Cap. The market advance came amid moderating inflation and signs that the US economy remains resilient despite higher interest rates. Similar themes from the first quarter carried into the second quarter, with the S&P 500 index finishing the first half of the year up 16.89%.

The drivers of performance diverged significantly, with the market breadth exceptionally narrow. Taking a deeper look into the S&P 500 Index, as a proxy for the broad market, seven stocks accounted for the majority of the period’s results; Tesla (TSLA), Microsoft (MSFT), Alphabet (GOOGL), Meta (META), Apple (AAPL), Amazon (AMZN), and Nvidia (NVDA). Excluding these seven, the rest of the market was up in the low single digits. In our view, sustaining that rally will be tough as the market’s focus will shift to identifying the longer-term AI winners with tangible supporting evidence.

Excitement around AI and the potential for a boom in automation as well as elevated levels of efficiency fueled investors’ appetite for companies positioned to benefit from the usage of data analytics and robotics. Recent break-throughs in generative AI were brought into the public sphere by OpenAI’s ChatGPT, including a wave of investor curiosity.

These seemingly new capabilities attract investors and business operators alike. With open access to emerging technology, anyone with an interest and access to the internet can quickly experiment with how organizations and individuals may better drive productivity and expand profit margins.

Performance Highlights

The Snow Small Cap Value strategy had an excellent quarter, significantly outperforming the benchmark by 760 basis points, returning 10.78% gross of fees (10.59% net of fees), while the Russell 2000 Value index gained only 3.18%. Year-to-date, the strategy is returning 11.08% gross of fees (10.69% net of fees) compared to the benchmark returning 2.50%. Over the trailing one-year period, the strategy is outperforming by an astounding 1,810 basis points, returning 24.10% gross of fees (23.24% net of fees), while the Russell 2000 Value is only up 6.01%. 1

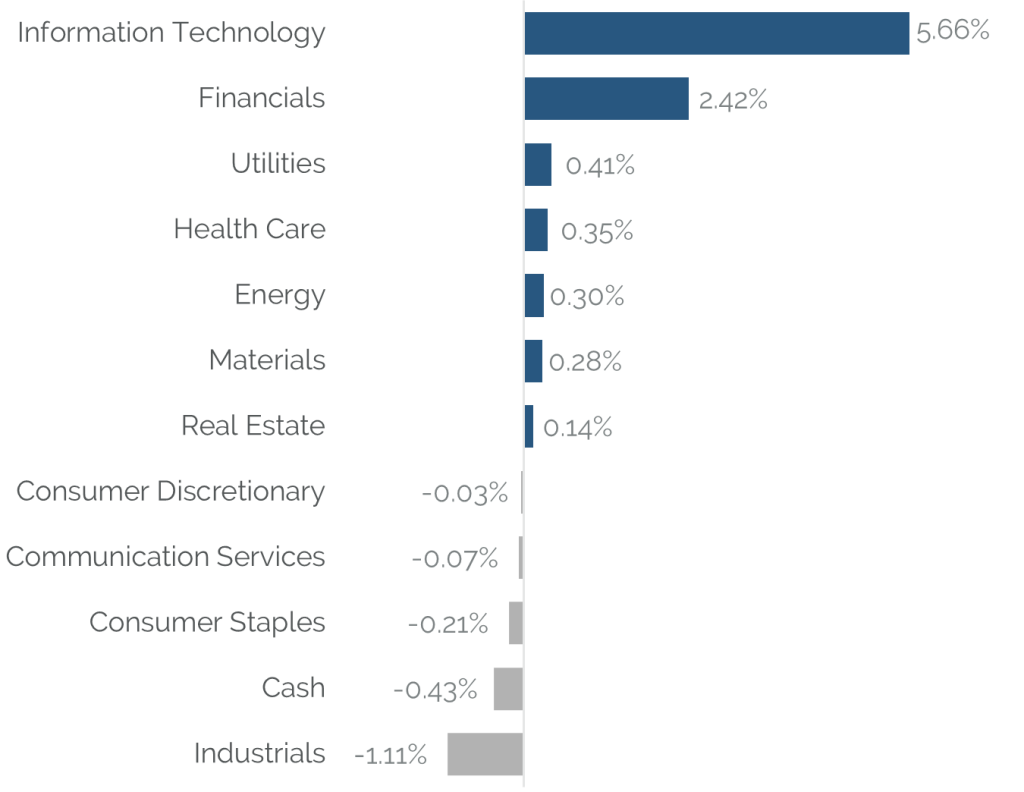

For the quarter, our Snow Small Cap Value strategy’s relative performance was driven almost entirely by stock selection, while sector positioning added a meager 10 basis points. Stock selection was exceptionally strong in Information Technology and Financials while Industrials and Consumer Discretionary were the only two sectors with negative stock selection. From an allocation perspective, our continued overweight position in Information Technology lead the way, followed by an underweight stance in Utilities. An underweight position in Industrials and a slight overweight in Consumer Staples detracted from relative performance.

Source: SEI Global Services as June 30, 2023

1Performance shown is the Easterly Investment Partners LLC (“the Firm”) Snow Small Cap Value composite in USD. Past performance is not indicative of future results. Gross performance results do not include advisory fees and other expenses an investor may incur, which when deducted will reduce returns. Changes in exchange rates may have adverse effects. Net performance results reflect the application of a model investment management fee which is higher than the actual average weighted management fee charged to accounts in the composite applied to gross performance results. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. The Firm claims compliance with the GIPS® standards; this information is supplemental to the GIPS® report included in this material. Returns greater than one year are annualized.

Portfolio Attribution

Top 5 Performance Contributors

| Stock | Avg Weight % | Contribution % |

|---|---|---|

| Super Micro Computer | 4.09 | 4.23 |

| Photronics | 3.99 | 2.03 |

| American Equity Investment Life | 3.93 | 1.57 |

| AMN Healthcare Services | 4.3 | 1.25 |

| Cross Country Healthcare | 3.78 | 0.93 |

Super Micro Computer (SMCI)

Shares of SMCI surged during the quarter as investors flocked to potential beneficiaries of AI. While AI is a large opportunity for SMCI (approximately a third of revenues in the most recent quarter), the company has been gaining share across several end markets, driving revenue growth and margin expansion in recent years. SMCI has longstanding partnerships with companies believed to be large winners from the boom in AI and they forecast robust growth for their AI infrastructure as CPU and GPU usage rise. SMCI is well-positioned for significant earnings growth, has a modest net cash position, and recently resumed a share repurchase. The next major catalyst is an update to FY’24 guidance.

Photronics (PLAB)

PLAB, a manufacturer of photomasks based in Brookfield, CT, outperformed during the quarter following strong demand and indications of share gains. The company’s position as the largest merchant of photomasks globally results in broad-based exposure and makes them less reliant on any single sector or region. As the market rewarded stocks who stood to benefit from long-term generative AI trends during the quarter, PLAB’s market leading position on a niche part of the global semiconductor supply chain began to be recognized by investors.

American Equity Investment (AEL)

AEL positively contributed to performance after Brookfield Reinsurance offered to buy the company for a significant premium. AEL has considered several bids for the company in recent years but we believe this offer is the first to reflect the underlying value in shares.

Top 5 Performance Detractors

| Stock | Avg Weight % | Contribution % |

|---|---|---|

| Integra LifeSciences | 2.3 | -0.84 |

| American Eagle Outfitters | 2.05 | -0.64 |

| Lions Gate Entertainment | 2.25 | -0.35 |

| BankUnited | 0.62 | -0.19 |

| Pilgrim’s Pride | 2.41 | -0.18 |

Integra LifeSciences (IART)

IART detracted during the quarter primarily due to a late-May voluntary recall of products manufactured at its Boston, MA facility, which accounted for about 5% of total revenue. The company plans to resume manufacturing at the facility after implementing additional controls, but the full-year revenue and EPS impact would be $60m/$0.35 if shut for the remainder of 2023. There are continued uncertainties surrounding the duration of the manufacturing stoppage, and we anticipate more color on the Q2 earnings call.

American Eagle Outfitters (AEO

AEO detracted from performance as the company reported deteriorating sales in Q1 and issued a conservative guide, reflecting below-average performance relative to peers. The company has not been able to convert healthy store traffic into sales, which may be related to a mix of elevated pricing, poor product selection, and competitive share loss. We liquidated our position to reallocate towards stocks with a more favorable risk-reward profile.

Lions Gate Entertainment (LGF)

LGF pulled back during the quarter as investors focused on what the capital structures will look like for both legacy LGF and for the anticipated STARZ spin-off, which is on-track for later in 2023. The stock is up more than 50% year-to-date despite the pull-back in Q2.

Source: SEI Global Services.

Securities shown represent the highest contributors and detractors to the portfolio’s performance for the period and do not represent all holdings within the portfolio. There is no guarantee that such holdings currently or will remain in the portfolio. For a complete list of holdings and an explanation of the methodology employed to determine this information, please contact Easterly. This information is not to be construed as an offer to buy or sell any financial instrument nor does it constitute an offer or invitation to invest in any fund managed by Easterly and has not been prepared in connection with any such offer.

Trailing Performance

as of June 30, 2023

| QTD | YTD | 1 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | Since Inception* | |

|---|---|---|---|---|---|---|---|---|

| Composite (Gross) | 10.78% | 11.08% | 24.10% | 28.52% | 8.52% | 11.06% | 8.34% | 9.19% |

| Composite (Net) | 10.59% | 10.69% | 23.24% | 27.64% | 7.76% | 10.29% | 7.59% | 8.43% |

| Russell 2000 Value | 3.18% | 2.50% | 6.01% | 15.43% | 3.54% | 7.69% | 7.29% | 5.81% |

Calendar Year Performance

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Composite (Gross) | -6.68% | 28.44% | 24.16% | 19.39% | -18.81% | 8.35% | 22.75% | -15.99% | 4.92% | 44.53% |

| Composite (Net) | -7.33% | 27.56% | 23.31% | 18.57% | -19.39% | 7.60% | 21.91% | -16.59% | 4.19% | 43.55% |

| Russell 2000 Value | -14.48% | 28.27% | 4.63% | 22.39% | -12.86% | 7.84% | 31.74% | -7.47% | 4.22% | 34.52% |

Source: SEI Global Services

*Inception: 10/31/06

Performance shown is the Easterly Investment Partners LLC (“the Firm”) Snow Small Cap Value composite in USD. Past performance is not indicative of future results. Gross performance results do not include advisory fees and other expenses an investor may incur, which when deducted will reduce returns. Changes in exchange rates may have adverse effects. Net performance results reflect the application of a model investment management fee which is higher than the actual average weighted management fee charged to accounts in the composite applied to gross performance results. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. The Firm claims compliance with the GIPS® standards; this information is supplemental to the GIPS® report included in this material. Returns greater than one year are annualized.

Top 10 Holdings

| Photronics | 5.10% |

| American Equity Investment Life | 4.72% |

| AMN Healthcare Services | 4.58% |

| Cross Country Healthcare | 3.93% |

| Bloomin’ Brands | 3.72% |

| CNO Financial Group | 3.68% |

| Brinker International | 3.63% |

| Commercial Metals | 3.44% |

| Cinemark Holdings | 3.40% |

| Delek US Holdings | 3.39% |

| Total | 39.59% |

Excludes cash and cash equivalents.

References to securities, transactions or holdings should not be considered a recommendation to purchase or sell a particular security and there is no assurance that, as of the date of publication, the securities remain in the portfolio. Additionally, it is noted that the securities or transactions referenced do not represent all of the securities purchased, sold or recommended during the period referenced and there is no guarantee as to the future profitability of the securities identified and discussed herein. Top ten holdings information shown combines share listings from the same issuer, and related depositary receipts, into a singular holding to accurately present aggregate economic interest in the referenced company.

Attribution vs Russell 2000 Value

Source: Bloomberg

Holdings, sector weightings, market capitalization and portfolio characteristics are subject to change at any time and are based on a representative portfolio, and may differ, sometimes significantly, from individual client portfolios.

Outlook

Looking ahead, we expect slow economic growth to weigh on demand. Many signs point to slowing growth. The yield curve remains inverted and Institute for Supply Management (ISM) indicators report declining levels.

For the past year, inflation has challenged central banks and weighed heavily on investors. With the Federal Reserve Bank (Fed) bringing about its sharpest tightening of monetary policy in decades, inflation is cooling slightly. In turn, we believe there will be an additional 25 to 50 basis point increase in the Fed Funds Rate over the remainder of the year until inflation is closer to the Fed target of 2.0%.

In our view, given the array of macroeconomic headwinds, the direction of equity prices will be more modest and driven by companies with favorable valuations and solid fundamentals. The environment is complex and paired with sectors experiencing different phases of the economic cycle, security selection is incredibly valuable. Our strategy is performing well due to the consistent application of our investment approach.

As such, we continue to hold companies with compelling business fundamentals, durable competitive advantages, and recurring revenue streams that are generating strong cash flows to fund future growth. We also favor effective management teams, which have the right balance of strategic vision, financial discipline, and capital allocation skills.

Taken together, we believe that we are invested in a collection of companies with above average earnings potential, driven by margin expansion and the shareholder friendly deployment of free cash flow. The portfolio is valued at just 8.67 x earnings while providing a free cash yield of 18.46% with a large portion of that free cash flow being paid out as dividends.

We remain dedicated to delivering strong long-term performance and transparent communications to our investors. As always, we welcome your comments and questions. Thank you for your commitment to Easterly Investment Partners.

Easterly Investment Partners LLC Snow Small Cap Value Composite GIPS® Report

Composite Inception Date: October 31, 2006

Composite Creation Date: July 1, 2021

| Year | Composite Performance | Annualized 3-Year Standard Deviation | Total Asset (millions) | Number of | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| End | Gross | Net | Russell 2000® Value | Composite | Russell | Composite | Total Firm Assets | Firm (AUM) | Firm (AUA)* | Composite | Accounts |

| 2000® Value | Dispersion | ||||||||||

| 2022 | -6.68% | -7.33% | -14.48% | 33.38% | 27.66% | N/A | 1,834 | 1,341 | 493 | 55 | Five or fewer |

| 2021 | 28.44% | 27.56% | 28.27% | 32.10% | 25.35% | N/A | 2,718 | 1,540 | 1,178 | 77 | Five or fewer |

| 2020 | 24.16% | 23.31% | 4.63% | 32.68% | 26.12% | 0.10% | - | - | 78 | Five or fewer | |

| 2019 | 19.39% | 18.57% | 22.39% | 20.50% | 15.70% | 0.20% | - | - | 82 | Five or fewer | |

| 2018 | -18.81% | -19.39% | -12.86% | 20.10% | 15.80% | N/A | - | - | 103 | Five or fewer | |

| 2017 | 8.35% | 7.60% | 7.84% | 18.20% | 14.00% | N/A | - | - | 421 | 6 | |

| 2016 | 22.75% | 21.91% | 31.74% | 18.40% | 15.50% | 0.60% | - | - | 627 | 10 | |

| 2015 | -15.99% | -16.59% | -7.47% | 15.00% | 13.50% | 0.50% | - | - | 643 | 12 | |

| 2014 | 4.92% | 4.19% | 4.22% | 15.20% | 12.80% | N/A | - | - | 557 | 9 | |

| 2013 | 44.53% | 43.55% | 34.52% | 20.30% | 15.80% | N/A | - | - | 141 | Five or fewer | |

Firm-wide advisory- only assets. Assets under Advisement (AUA) includes the assets where Easterly Investment Partners (“Easterly”) provides its advisory services in similar strategies and does not have discretionary trading authority.

Firm Definition

For purposes of complying with the GIPS® standards, the firm is defined as Easterly Investment Partners LLC (“EIP”) which is an SEC registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, effective January 2019. The firm was redefined on 1/1/2023 to reflect that EIP is comprised of two distinct firms: the institutional asset management operations, investment strategies, performance track records, certain employees and client accounts of Levin Capital Strategies, which were acquired by EIP in March 2019, and Snow Capital Management LLC’s (“SCM”) asset management business, investment strategies, performance track records, client accounts, and certain employees, acquired by EIP in July 2021.

Firm Verification Statement

Easterly claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Easterly has been independently verified for the period April 1, 2019 through December 31, 2022. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

Composite Verification Statement

The Snow Small Cap Value Composite has had a performance examination from composite inception date through December 31, 2022. The verification and performance examination reports are available upon request.

Composite Description

The Snow Small Cap composite provides exposure to long-only US publicly-listed securities and ADRs, and may occasionally invest in convertible and corporate bonds, taking into account various factors. The strategy is biased toward Small capitalization value stocks, and position sizes range between 0.5% to 5%, with liquidity as a consideration.

Benchmark Description

The Russell 2000 Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. Indexes are unmanaged. It is not possible to invest directly in an index.

Performance Calculation

All returns are calculated and presented in US dollars based on fully discretionary AUM, including those investors no longer with the firm. All gross composite returns are net of transaction costs and gross of foreign withholding taxes, if any, and reflect the reinvestment of interest income and other earnings. Net performance results reflect the application of a model investment management fee which is higher than the actual average weighted management fee charged to accounts in the composite applied to gross performance results. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. Actual investment advisory fees incurred by clients will vary. Policies for valuing investments, calculating performance, and preparing GIPS reports are available upon request. A list of composite descriptions is available upon request. Past performance is not indicative of future performance. Results may be higher or lower based on IPO eligibility, and actual investor’s returns may differ, depending upon date(s) of investment(s). Additional information is available upon request.

Investment Management Fee Schedule

The current standard management fee schedule for a segregated account managed to the composite strategy is as follows: 0.70% on the first $25 million; 0.55% on the next $75 million; 0.50% on the next $100 million; 0.45% on the next $100 million; 0.35% on the balance.

Composite Dispersion

The annual composite dispersion, if shown, is an asset-weighted standard deviation calculated using gross returns for the accounts in the composite the entire year. The internal dispersion measure is not applicable if there are five or fewer portfolios in the composite for the entire year if that is the reason this is N/A.

Standard Deviation

The annualized 3-year standard deviation represents the annualized standard deviation of actual gross composite and benchmark returns, using the rolling 36 months ended each year end. Standard deviation is a measurement of historical volatility of investment returns.

Trademark

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Important Disclosures

© 2023. Easterly Asset Management. All rights reserved.

Easterly Asset Management’s advisory affiliates (collectively, “EAM” or “the Firm”), including Easterly Investment Partners LLC, Easterly Funds LLC, and Easterly EAB Risk Solutions LLC (“Easterly EAB”) are registered with the SEC as investment advisers under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its investment strategies and objectives, can be found in each affiliate’s Form ADV Part 2 which is available on the www.sec.gov website. This information has been prepared solely for the use of the intended recipients; it may not be reproduced or disseminated, in whole or in part, without the prior written consent of EAM.

No funds or investment services described herein are offered or will be sold in any jurisdiction in which such an offer or sale would be unlawful under the laws of such jurisdiction. No such fund or service is offered or will be sold in any jurisdiction in which registration, licensing, qualification, filing or notification would be required unless such registration, license, qualification, filing, or notification has been effected.

The material contains information regarding the investment approach described herein and is not a complete description of the investment objectives, risks, policies, guidelines or portfolio management and research that supports this investment approach. Any decision to engage the Firm should be based upon a review of the terms of the prospectus, offering documents or investment management agreement, as applicable, and the specific investment objectives, policies and guidelines that apply under the terms of such agreement. There is no guarantee investment objectives will be met. The investment process may change over time. The characteristics set forth are intended as a general illustration of some of the criteria the strategy team considers in selecting securities for client portfolios. Client portfolios are managed according to mutually agreed upon investment guidelines. No investment strategy or risk management techniques can guarantee returns or eliminate risk in any market environment. All information in this communication has been obtained from sources believed to be reliable but cannot be guaranteed. Investment products are not FDIC insured and may lose value.

Investments are subject to market risk, including the loss of principal. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate. The information contained herein does not consider any investor’s investment objectives, particular needs, or financial situation and the investment strategies described may not be suitable for all investors. Individual investment decisions should be discussed with a personal financial advisor.

Any opinions, projections and estimates constitute the judgment of the portfolio managers as of the date of this material, may not align with the Firm’s opinion or trading strategies, and may differ from other research analysts’ opinions and investment outlook. The information herein is subject to change without notice and may be superseded by subsequent market events or for other reasons. EAM assumes no obligation to update the information herein.

References to securities, transactions or holdings should not be considered a recommendation to purchase or sell a particular security and there is no assurance that, as of the date of publication, the securities remain in the portfolio. Additionally, it is noted that the securities or transactions referenced do not represent all of the securities purchased, sold or recommended during the period referenced and there is no guarantee as to the future profitability of the securities identified and discussed herein. As a reminder, investment return and principal value will fluctuate.

The indices cited are, generally, widely accepted benchmarks for investment performance within their relevant regions, sectors or asset classes, and represent non managed investment portfolio. It is not possible to invest directly in an index.

This communication may contain forward-looking statements, which reflect the views of EAM and/or its affiliates. These forward-looking statements can be identified by reference to words such as “believe”, “expect”, “potential”, “continue”, “may”, “will”, “should”, “seek”, “approximately”, “predict”, “intend”, “plan”, “estimate”, “anticipate” or other comparable words. These forward-looking statements or other predications or assumptions are subject to various risks, uncertainties, and assumptions. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Should any assumptions underlying the forward-looking statements contained herein prove to be incorrect, the actual outcome or results may differ materially from outcomes or results projected in these statements. EAM does not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by applicable law or regulation.

Past performance is no guarantee of future results.