Market Summary

Major market indices declined during the quarter as investors digested inflation and the Federal Reserve’s (Fed) interest rate policy. Across the market cap size and style spectrum, there was dispersion of results. In large caps, growth and value indices were essentially in-line for the quarter, but large cap growth indices continue to significantly outperform large cap value year-to-date. On the small cap side, value outperformed growth during the quarter, and the year-to-date spread between growth and value is much narrower.

Seven S&P 500 companies – Apple, Microsoft, Amazon, Google, Nvidia, Tesla, and Meta (Facebook) – have remained top of mind for many investors this year. These companies, which have been dubbed the “Magnificent Seven”, are the largest U.S. based companies by market cap and have driven a large portion of the broad markets return for the year-to-date period. They only represent 28% of the S&P 500 Index, but contributed almost 65% of the S&P 500 Index year-to-date return. This narrow leadership has led to a market that is trading at heightened valuations, with the forward price-to-earnings (P/E) multiple of the S&P 500 at close to 18x. The spread between the average P/E ratio for the seven largest companies in the S&P 500 and that of the rest of the index has rarely been this wide. If you disregard the Magnificent Seven and look under the hood, you will find the market is cheaper, at approximately 16x forward earnings; however, the last time the 10-year UST was 4.69% was in October of 2007 when the forward P/E of the S&P 500 was only 12.5x next years earnings. In turn, the broad market, indicated by the S&P 500, is still at a heightened valuation. Perhaps more important to some investors, the yield on three-month Treasury bills now exceeds the earnings yield — the inverse of the P/E ratio— for the S&P 500, excluding the top seven, by close to 1.2%. It is the first time the yield on T-bills exceeds the group’s earnings yield since 2000 and is the third-highest spread favoring T-bills on record.

The recent, sharp rise in yields has created a challenging investment backdrop. During the quarter, the benchmark 10-year UST increased from 3.81% to 4.59%. The swift move in Fed Funds to 5.5% should begin to dampen growth. The longer rates stay elevated, the larger the economic drag will be, as more and more activity will be subject to higher rates. A related detriment to economic growth is continued stress in the Financials and Real Estate sectors. These higher rates serve as a ceiling on equity valuations and will likely keep markets in a choppy holding pattern in coming quarters.

Performance Highlights

The Snow Focused Value strategy outperformed during the quarter, returning -1.93% gross of fees (-2.16% net of fees), while the Russell 1000 Value index fell -3.16%. Year-to-date, the strategy has now returned 5.67% gross of fees (4.92% net of fees), while the index has gained only 1.79%.

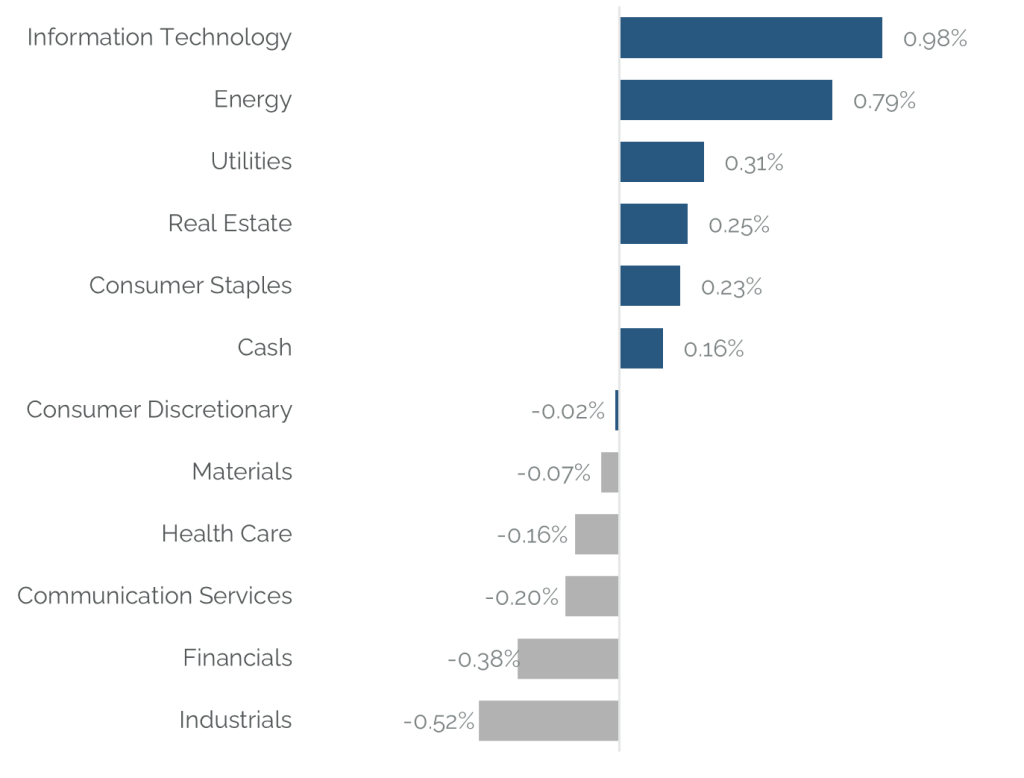

For the quarter, the Snow Focused Value strategy’s relative performance was driven largely by positive sector positioning, but stock selection added value as well. The strategy benefitted the most from its overweight position in Energy, while the underweight stance in Utilities and Real Estate added value as well. An overweight position in Consumer Discretionary detracted value. In terms of stock selection, the largest contributors were Information Technology and Consumer Discretionary, while Industrials and Financials were the largest detractors.

Source: SEI Global Services as September 30, 2023

Performance shown is the Easterly Investment Partners LLC (“the Firm”) Snow Focused Value composite in USD. Past performance is not indicative of future results. Gross performance results do not include advisory fees and other expenses an investor may incur, which when deducted will reduce returns. Changes in exchange rates may have adverse effects. Net performance results reflect the application of a model investment management fee which is higher than the actual average weighted management fee charged to accounts in the composite applied to gross performance results. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. The Firm claims compliance with the GIPS® standards; this information is supplemental to the GIPS® report included in this material. Returns greater than one year are annualized.

Portfolio Attribution

Top 5 Performance Contributors

| Stock | Avg Weight % | Contribution % |

|---|---|---|

| SUPER MICRO COMPUTER INC | 3.03 | 0.93 |

| SUNCOR ENERGY INC | 3.91 | 0.66 |

| MARATHON OIL CORP | 4.16 | 0.59 |

| ABBVIE INC | 4.24 | 0.42 |

| RANGE RESOURCES CORP | 3.81 | 0.37 |

Super Micro Computer (SMCI)

Shares of SMCI surged leading up to the company’s earnings report in early August, providing us an opportunity to reduce the position size as the company faced lofty expectations related to the benefits from surging AI demand. The stock gave back most of the gains following the report as the company’s guidance for FY2024 was short of the most bullish expectations due to capacity constraints within the supply chain. SMCI has longstanding partnerships with companies believed to be large winners from the boom in AI and the company forecasts robust growth for its AI infrastructure as CPU and GPU usage rise. SMCI is primed for significant earnings growth, has a modest net cash position, and recently resumed a share repurchase.

Suncor Energy (SU)

Shares of SU outperformed during the second quarter, following oil prices, which have been supported by OPEC+’s resolve to cut supplies, as uncertainty around the global economic outlook weighed on prices in the first half of 2023. Even with the outperformance, shares of SU remain attractive as management refocuses operations to oil production. Shares are trading at 7X forward earnings and are yielding 5%.

Marathon Petroleum Corporation (MPC)

MPC delivered strong performance during the quarter, driven by resilient refined product demand, in an environment where global refining capacity additions have not responded, leading to stronger than normal refining margins or crack spreads. MPC has potentially the strongest balance sheet in the S&P 500 and despite a seemingly never-ending chorus of market participants predicting recession, remains well positioned in the current environment. MPC continues to return significant capital to shareholders, repurchasing $3.1B of shares during 2Q, paying $316mn in dividends and repurchasing an additional 0.9bn shares in July.

Top 5 Performance Detractors

| Stock | Avg Weight % | Contribution % |

|---|---|---|

| ZIMMER BIOMET HOLDINGS INC | 4.17 | -1.07 |

| WESCO INTERNATIONAL INC | 5.09 | -1.03 |

| PVH CORP | 5.01 | -0.53 |

| CITIGROUP INC | 4.00 | -0.45 |

| PFIZER INC | 3.78 | -0.38 |

Zimmer Biomet (ZBH)

Shares of medical device company ZBH negatively impacted performance during the quarter as investors question the trajectory of ZBH’s recent growth, which has been buoyed by a broad recovery in procedures. ZBH also announced an unexpected management change. We continue to hold ZBH as we believe the company has gained share and has solid pricing momentum. The stock trades at 13x our normalized earnings estimate.

WESCO International (WCC)

Shares in WCC lost value during the quarter. The company reported weak results across the board. WCC is suffering from supply chain rebalancing in the electrical industry, leading to customer destocking. Moreover, weakness in certain sectors, including commercial construction and manufactured structures has been a headwind. We continue to hold the position and believe this is a short term issue that WCC will work through. The company has is a solid organization with a strong historical free cash flow and debt pay-down history. We expect WCC to benefit from greater bargaining power with customers and suppliers that should help the company battle the ongoing tough price/cost backdrop.

PVH (PVH)

Apparel company, PVH detracted from performance due to uncertainty around the global economy and how lower discretionary spending could impact consumer demand. Despite the uncertainty, PVH has delivered and raised guidance through 2023 as the company has implemented their PVH+ Plan, focused on operational improvement through reducing their inventory/sales by 25%. Execution of this plan will support gross margins even through a recession and provide sustainably higher earnings. Shares are currently trading a 7X current year earnings estimates and 6.5X forward estimates as investors remain skeptical. PVH has a pristine balance sheet and is generating >$700mn in FCF.

Source: SEI Global Services.

Securities shown represent the largest contributors and detractors to the portfolio’s performance for the period and do not represent all holdings within the portfolio. There is no guarantee that such holdings are currently or will remain in the portfolio. For a complete list of holdings and an explanation of the methodology employed to determine this information, please contact Easterly. This information is not to be construed as an offer to buy or sell any financial instrument nor does it constitute an offer or invitation to invest in any fund managed by Easterly and has not been prepared in connection with any such offer.

Trailing Performance

as of September 30, 2023

| QTD | YTD | 1 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | Since Inception* | |

|---|---|---|---|---|---|---|---|---|

| Composite (gross) | -1.93% | 5.67% | 19.83% | 18.91% | 8.10% | 9.40% | 8.05% | 13.60% |

| Composite (net) | -2.16% | 4.92% | 18.70% | 17.80% | 7.08% | 8.37% | 7.03% | 12.54% |

| Russell 1000 Value | -3.16% | 1.79% | 14.44% | 11.05% | 6.22% | 7.91% | 8.44% | 10.73% |

Calendar Year Performance

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Composite (gross) | -1.11% | 31.80% | 2.56% | 28.00% | -18.03% | 17.76% | 15.10% | -18.20% | 15.17% | 50.18% |

| Composite (net) | -2.04% | 30.57% | 1.59% | 26.81% | -18.81% | 16.66% | 14.03% | -18.99% | 14.10% | 48.81% |

| Russell 1000 Value | -7.54% | 25.16% | 2.80% | 26.54% | -8.27% | 13.66% | 17.34% | -3.83% | 13.45% | 32.53% |

Source: SEI Global Services

Inception: 12/31/08

Performance shown is the Easterly Investment Partners LLC (“the Firm”) Snow Focused Value composite in USD. Past performance is not indicative of future results. Gross performance results do not include advisory fees and other expenses an investor may incur, which when deducted will reduce returns. Changes in exchange rates may have adverse effects. Net performance results reflect the application of a model investment management fee which is higher than the actual average weighted management fee charged to accounts in the composite applied to gross performance results. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. The Firm claims compliance with the GIPS® standards; this information is supplemental to the GIPS® report included in this material. Returns greater than one year are annualized.

Top 10 Holdings

| JPMORGAN CHASE & CO | 5.82% |

| CENTENE CORP | 5.08% |

| PVH CORP | 5.00% |

| WESCO INTERNATIONAL INC | 4.92% |

| MARATHON OIL CORP | 4.66% |

| CITIGROUP INC | 4.64% |

| SUNCOR ENERGY INC | 4.32% |

| ABBVIE INC | 4.29% |

| PFIZER INC | 4.17% |

| RANGE RESOURCES CORP | 4.07% |

| Total | 46.97% |

|---|

Excludes cash and cash equivalents.

References to securities, transactions or holdings should not be considered a recommendation to purchase or sell a particular security and there is no assurance that, as of the date of publication, the securities remain in the portfolio. Additionally, it is noted that the securities or transactions referenced do not represent all of the securities purchased, sold or recommended during the period referenced and there is no guarantee as to the future profitability of the securities identified and discussed herein. Top ten holdings information shown combines share listings from the same issuer, and related depositary receipts, into a singular holding to accurately present aggregate economic interest in the referenced company.

Attribution vs Russell 1000 Value

Source: Bloomberg

Holdings, sector weightings, market capitalization and portfolio characteristics are subject to change at any time and are based on a representative portfolio, and may differ, sometimes significantly, from individual client portfolios.

Outlook

In our view, an important theme for the quarters ahead will be to “follow the earnings.” Most of the market advance for the year-to-date period has been about prices going up as opposed to earnings growth. We expect more of the same on the economy—a slow rate of growth, hovering just above zero. We expect large divergences across companies as they navigate this environment and position themselves to preserve profit margins. Even though we expect the broad markets to return muted results, we continue to find companies with compelling business fundamentals, durable competitive advantages, and recurring revenue streams that are generating strong cash flows to fund future growth. We also favor effective management teams, which have the right balance of strategic vision, financial discipline, and capital allocation skills.

In closing, we remain dedicated to delivering strong long-term performance and transparent communications to our investors. Thank you for your confidence and commitment in Easterly Investment Partners. As always, we welcome your comments and questions.

Easterly Investment Partners LLC Snow Focused Value Composite GIPS® Report

Composite Inception Date: December 31, 2008

Composite Creation Date: 07/01/2021

| Year End | Composite Performance | Annualized 3-Year Standard Deviation | Total Assets (millions) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Gross | Net | Russell 1000® Value | Composite | Russell 1000® Value | Composite Dispersion | Total Firm Assets | Firm (AUM) | Firm (AUA)* | Composite | Number of Accounts | |

| 2022 | -1.11% | -2.04% | -7.54% | 25.73% | 21.55% | N/A | 1,834 | 1,341 | 493 | 1 | Five or fewer |

| 2021 | 31.80% | 30.57% | 25.16% | 24.28% | 19.33% | N/A | 2718 | 1540 | 1178 | 30 | Five or fewer |

| 2020 | 2.56% | 1.59% | 2.80% | 24.63% | 19.62% | 0.10% | - | - | 26 | 10 | |

| 2019 | 28.00% | 26.81% | 26.54% | 14.90% | 11.90% | 0.14% | - | - | 31 | 9 | |

| 2018 | -18.03% | -18.81% | -8.27% | 15.30% | 10.80% | 0.05% | - | - | 3 | 8 | |

| 2017 | 17.76% | 16.66% | 13.66% | 16.65% | 10.20% | 0.06% | - | - | 5 | 8 | |

| 2016 | 15.10% | 14.03% | 17.34% | 17.07% | 10.77% | N/A | - | - | 25 | 6 | |

| 2015 | -18.20% | -18.99% | -3.83% | 15.63% | 10.68% | N/A | - | - | 26 | 7 | |

| 2014 | 15.17% | 14.10% | 13.45% | 13.98% | 9.20% | N/A | - | - | 37 | Five or Fewer | |

| 2013 | 50.18% | 48.81% | 32.53% | 19.22% | 12.70% | N/A | - | - | 1 | Five or fewer | |

Firm-wide advisory- only assets. Assets under Advisement (AUA) includes the assets where Easterly Investment Partners (“Easterly”) provides its advisory services in similar strategies and does not have discretionary trading authority.

Firm Definition

For purposes of complying with the GIPS® standards, the firm is defined as Easterly Investment Partners LLC (“EIP”) which is an SEC registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended, effective January 2019. The firm was redefined on 1/1/2023 to reflect that EIP is comprised of two distinct firms: the institutional asset management operations, investment strategies, performance track records, certain employees and client accounts of Levin Capital Strategies, which were acquired by EIP in March 2019, and Snow Capital Management LLC’s (“SCM”) asset management business, investment strategies, performance track records, client accounts, and certain employees, acquired by EIP in July 2021.

Firm Verification Statement

Easterly claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Easterly has been independently verified for the period April 1, 2019 through December 31, 2022. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis.

Composite Verification Statement

The Focused Value Composite has had a performance examination from composite inception date through December 31, 2022. The verification and performance examination reports are available upon request.

Composite Description

The Focused Value composite provides concentrated exposure to the mid- and large-capitalization segments of the value equity market.

Benchmark Description

The Russell 1000® Value Total Return Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. The total return index is the price level index plus the dividend reinvested. Indexes are unmanaged. It is not possible to invest directly in an index.

Performance Calculation

All returns are calculated and presented in US dollars based on fully discretionary AUM, including those investors no longer with the firm. All gross composite returns are net of transaction costs and gross of foreign withholding taxes, if any, and reflect the reinvestment of interest income and other earnings. Net performance results reflect the application of a model investment management fee which is higher than the actual average weighted management fee charged to accounts in the composite applied to gross performance results. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. Actual investment advisory fees incurred by clients will vary. Policies for valuing investments, calculating performance, and preparing GIPS reports are available upon request. A list of composite descriptions is available upon request. Past performance is not indicative of future performance. Results may be higher or lower based on IPO eligibility, and actual investor’s returns may differ, depending upon date(s) of investment(s). Additional information is available upon request.

Investment Management Fee Schedule

The current standard management fee schedule for a segregated account managed to the composite strategy is as follows: 0.95% on assets.

Composite Dispersion

The annual composite dispersion, if shown, is an asset-weighted standard deviation calculated using gross returns for the accounts in the composite the entire year. The internal dispersion measure is not applicable if there are five or fewer portfolios in the composite for the entire year if that is the reason this is N/A.

Standard Deviation

The annualized 3-year standard deviation represents the annualized standard deviation of actual gross composite and benchmark returns, using the rolling 36 months ended each year end. Standard deviation is a measurement of historical volatility of investment returns.

Trademark

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Important Disclosures

© 2023. Easterly Asset Management. All rights reserved.

Easterly Asset Management’s advisory affiliates (collectively, “EAM” or “the Firm”), including Easterly Investment Partners LLC, Easterly Funds LLC, and Easterly EAB Risk Solutions LLC (“Easterly EAB”) are registered with the SEC as investment advisers under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its investment strategies and objectives, can be found in each affiliate’s Form ADV Part 2 which is available on the www.sec.gov website. This information has been prepared solely for the use of the intended recipients; it may not be reproduced or disseminated, in whole or in part, without the prior written consent of EAM.

No funds or investment services described herein are offered or will be sold in any jurisdiction in which such an offer or sale would be unlawful under the laws of such jurisdiction. No such fund or service is offered or will be sold in any jurisdiction in which registration, licensing, qualification, filing or notification would be required unless such registration, license, qualification, filing, or notification has been effected.

The material contains information regarding the investment approach described herein and is not a complete description of the investment objectives, risks, policies, guidelines or portfolio management and research that supports this investment approach. Any decision to engage the Firm should be based upon a review of the terms of the prospectus, offering documents or investment management agreement, as applicable, and the specific investment objectives, policies and guidelines that apply under the terms of such agreement. There is no guarantee investment objectives will be met. The investment process may change over time. The characteristics set forth are intended as a general illustration of some of the criteria the strategy team considers in selecting securities for client portfolios. Client portfolios are managed according to mutually agreed upon investment guidelines. No investment strategy or risk management techniques can guarantee returns or eliminate risk in any market environment. All information in this communication has been obtained from sources believed to be reliable but cannot be guaranteed. Investment products are not FDIC insured and may lose value.

Investments are subject to market risk, including the loss of principal. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate. The information contained herein does not consider any investor’s investment objectives, particular needs, or financial situation and the investment strategies described may not be suitable for all investors. Individual investment decisions should be discussed with a personal financial advisor.

Any opinions, projections and estimates constitute the judgment of the portfolio managers as of the date of this material, may not align with the Firm’s opinion or trading strategies, and may differ from other research analysts’ opinions and investment outlook. The information herein is subject to change without notice and may be superseded by subsequent market events or for other reasons. EAM assumes no obligation to update the information herein.

References to securities, transactions or holdings should not be considered a recommendation to purchase or sell a particular security and there is no assurance that, as of the date of publication, the securities remain in the portfolio. Additionally, it is noted that the securities or transactions referenced do not represent all of the securities purchased, sold or recommended during the period referenced and there is no guarantee as to the future profitability of the securities identified and discussed herein. As a reminder, investment return and principal value will fluctuate.

The indices cited are, generally, widely accepted benchmarks for investment performance within their relevant regions, sectors or asset classes, and represent non managed investment portfolio. It is not possible to invest directly in an index.

This communication may contain forward-looking statements, which reflect the views of EAM and/or its affiliates. These forward-looking statements can be identified by reference to words such as “believe”, “expect”, “potential”, “continue”, “may”, “will”, “should”, “seek”, “approximately”, “predict”, “intend”, “plan”, “estimate”, “anticipate” or other comparable words. These forward-looking statements or other predications or assumptions are subject to various risks, uncertainties, and assumptions. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Should any assumptions underlying the forward-looking statements contained herein prove to be incorrect, the actual outcome or results may differ materially from outcomes or results projected in these statements. EAM does not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by applicable law or regulation.

Past performance is no guarantee of future results.

20231020-3179190-10095506