The Federal Reserve kept its key interest rate at 5.25% to 5.5% at its July 31 meeting. During the press conference, Fed Chair Jerome Powell cited that progress had been made toward the Fed’s 2% inflation goal and said a rate cut in September is “on the table,” provided inflation data remained under control.

Following yesterday’s meeting, the 10-year Treasury yield fell below 4% for the first time since February on Thursday after a manufacturing gauge and jobless claims data added to evidence that the US labor market is cooling. The market move precedes Friday’s anticipated release of broader US employment data for July.

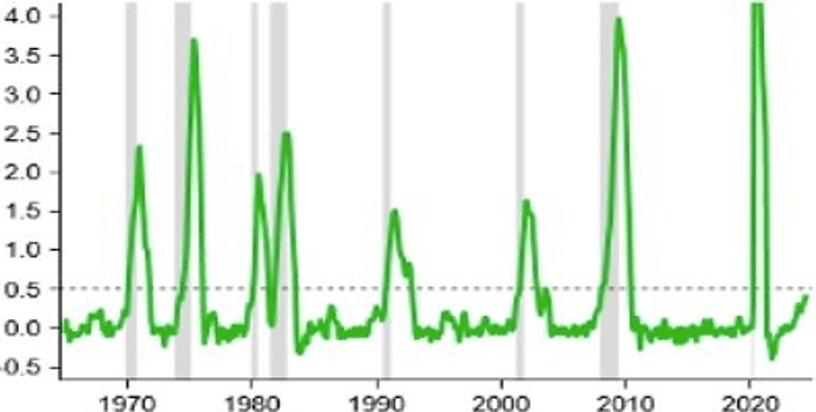

Sahm Rule Suggests Recession Risks are Increasing |

|

| Source: Federal Reserve, TD Securities. As of 6/30/2024 |

Unemployment data is now close to triggering a recession indicator. If the employment rate rises to 4.2% in July from its June Level of 4.1%, it would trigger the “Sahm rule” which states that if the three-month moving average of the unemployment rate rises half a percentage point from its low point in the previous 12 months, then the economy is in a recession. During the press conference, Powell was asked about the “Sahm rule” and he stated that what “we’re seeing is a normalizing labor market,” though if “it starts to show signs that it’s more than that, then we’re well positioned to respond.”

US government bonds had their best month of the year in July, returning 2.2% as swap traders fully priced in three quarter- point cuts at each of the Fed’s remaining policy meetings, according to the CME Group. Fixed-income ETFs also took in a historic amount of cash as investors piled into the bond market, positioning for the start of a Fed rate-cutting cycle. Bond funds saw inflows of roughly $39 billion in July, the most on record.

Market pricing also reflects investors’ growing concern that the Fed might need to cut rates more quickly than the 25-basispoint quarterly cadence as economic headwinds continue to mount. However, while Powell mentioned that “we’re getting closer to the point at which it will be appropriate to begin to dial back restriction,” he also cautioned against assuming that a cut was definitely happening, stating “we’re not at the point yet. We want to see more good data.” He also seemed to rule out the likelihood of a 50 basis-point rate cut.

Rates have rallied over the last few days due to a combination of a more dovish Fed, moderating economic data, and geopolitical risks. If the employment data is weak tomorrow it could spur further momentum for the bull steepening trend. However, the Treasury market has indicators of crowded positioning based on expectations of a substantial easing cycle ahead of the July employment report. There are echoes from the start of the year when those who expected at least six quarter-point cuts were disappointed after inflation stopped slowing, prompting a violent rebound in yields that pushed the 10-year to around 4.75% in late April. Thus, any signs that the disinflation trend is waning, or stronger than expected employment data could spur a back-up in rates as bullish bets are trimmed.

Easterly Asset Management’s advisory affiliates (collectively, “EAM” or “the Firm”), including Easterly Investment Partners LLC, Easterly Funds LLC, and Easterly EAB Risk Solutions LLC (“Easterly EAB”) are registered with the SEC as investment advisers under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its investment strategies and objectives, can be found in each affiliate’s Form ADV Part 2 which is available on the www.sec.gov website. This information has been prepared solely for the use of the intended recipients; it may not be reproduced or disseminated, in whole or in part, without the prior written consent of EAM.

No funds or investment services described herein are offered or will be sold in any jurisdiction in which such an offer or sale would be unlawful under the laws of such jurisdiction. No such fund or service is offered or will be sold in any jurisdiction in which registration, licensing, qualification, filing or notification would be required unless such registration, license, qualification, filing, or notification has been affected.

The material contains information regarding the investment approach described herein and is not a complete description of the investment objectives, risks, policies, guidelines or portfolio management and research that supports this investment approach. Any decision to engage the Firm should be based upon a review of the terms of the prospectus, offering documents or investment management agreement, as applicable, and the specific investment objectives, policies and guidelines that apply under the terms of such agreement. There is no guarantee investment objectives will be met. The investment process may change over time. The characteristics set forth are intended as a general illustration of some of the criteria the strategy team considers in selecting securities for client portfolios. Client portfolios are managed according to mutually agreed upon investment guidelines. No investment strategy or risk management techniques can guarantee returns or eliminate risk in any market environment. All information in this communication has been obtained from sources believed to be reliable but cannot be guaranteed. Investment products are not FDIC insured and may lose value.

Investments are subject to market risk, including the loss of principal. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate. The information contained herein does not consider any investor’s investment objectives, particular needs, or financial situation and the investment strategies described may not be suitable for all investors. Individual investment decisions should be discussed with a personal financial advisor.

Any opinions, projections and estimates constitute the judgment of the portfolio managers as of the date of this material, may not align with the Firm’s opinion or trading strategies, and may differ from other research analysts’ opinions and investment outlook. The information herein is subject to change without notice and may be superseded by subsequent market events or for other reasons. EAM assumes no obligation to update the information herein.

References to securities, transactions or holdings should not be considered a recommendation to purchase or sell a particular security and there is no assurance that, as of the date of publication, the securities remain in the portfolio. Additionally, it is noted that the securities or transactions referenced do not represent all of the securities purchased, sold or recommended during the period referenced and there is no guarantee as to the future profitability of the securities identified and discussed herein. As a reminder, investment return and principal value will fluctuate.

The indices cited are, generally, widely accepted benchmarks for investment performance within their relevant regions, sectors or asset classes, and represent non managed investment portfolio. It is not possible to invest directly in an index.

This communication may contain forward-looking statements, which reflect the views of EAM and/or its affiliates. These forward-looking statements can be identified by reference to words such as “believe”, “expect”, “potential”, “continue”, “may”, “will”, “should”, “seek”, “approximately”, “predict”, “intend”, “plan”, “estimate”, “anticipate” or other comparable words. These forward-looking statements or other predications or assumptions are subject to various risks, uncertainties, and assumptions. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Should any assumptions underlying the forward-looking statements contained herein prove to be incorrect, the actual outcome or results may differ materially from outcomes or results projected in these statements. EAM does not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by applicable law or regulation.

Past performance is not indicative of future results.

20240802-3766005